When making decisions in credit we know that you need to make decisions fast and effectively. Our credit reports give credit professionals an in-depth, but easy to read report to help you make credit decisions.

Sometimes additional information is needed when making a decision regarding past due accounts. That is where our Historical A/R section can help. In this article, we will go through a couple of tips for interpreting and using the Historical A/R section to better understand a business.

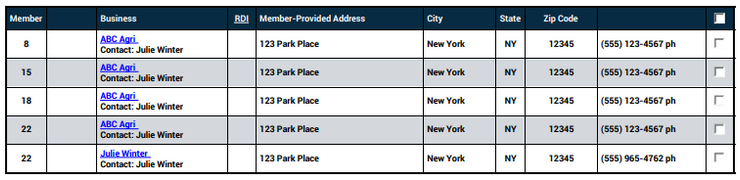

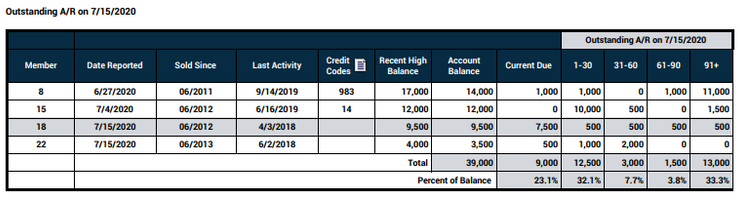

When reviewing the ICE Report, on the top half you have a list of the accounts tied to the business and the outstanding A/R.

On the bottom half, you will see the historical data that represents each time a member reported on their accounts. We have condensed each member section to include all accounts listed on the top into a single line to make the data easier to read.

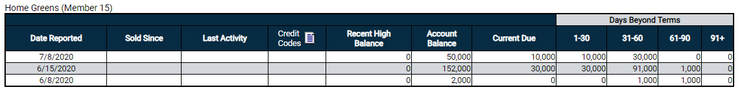

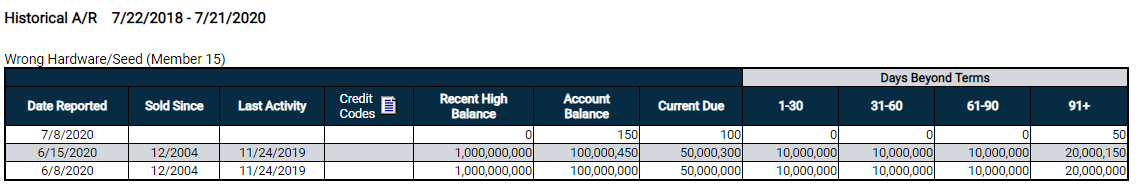

We have found that the most common instance our members look through Historical A/R is to look for patterns in aging. Looking at this portion of the report can be a great visual aid in seeing when and how often a business is aging out.

In the example below, it can be inferred that this business had consistently aged out into 61-90 day bucket. This gives our members an idea of accounts that are slow with other companies in their industry and what they may expect with the potential business if they are thinking of extending credit or currently sell to an account.

The below example also gives clues to the business potential being in trouble with the balance creeping into the 91+ column and staying there.

Contact ICE Support at ICESupport@ICECreditexchange.com if you would like additional training or information.